How the new GST law can help your business grow?

- September 15, 2017

- Posted by: A S Akruwala

- Category: GST

No Comments

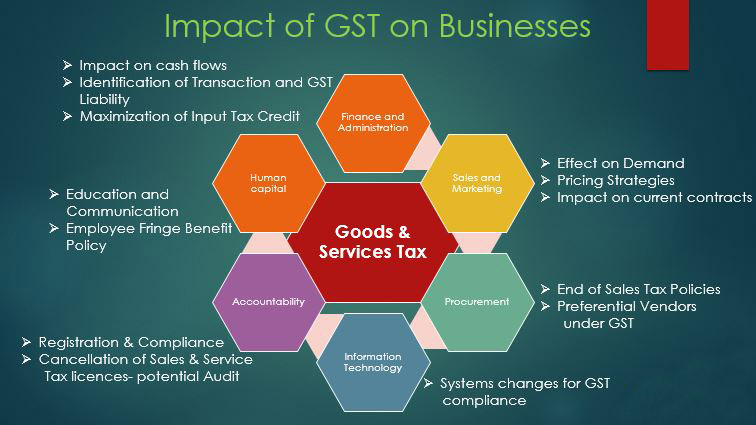

Wondering how GST will influence your business or whether it will have a positive or negative impact? Free your mind from this dilemma as we tell you how your business can develop under the GST law. With the implementation of the new GST law on 1st July 2017, businesses are expected to go through a major transformation in the way they operate.

- Elimination of the cascading effect of tax : GST has been designed to abolish the tax-on-tax system completely by subsuming a variety of taxes like Service tax, VAT, Krishi Kalyan Cess etc. With a less complicated system you not only get the benefit of paying a single tax but also avoid the pile-up of multiple taxes due to the cascading effect. The impact on your business is obviously expected to be nothing less than positive.

- Lesser operational costs: The GST law is expected to allow businesses to observe a decrease in operational costs, which in turn will increase the profit margin due to conversion of VAT into GST. Needless to say, less operational costs will open more doors for expansion.

- Reduction in transportation time: The reduction in sales and entry taxes by 50% at the state border check-posts will not only save precious transportation time for your business but will also ensure easier movements across state borders. This will obviously have a positive impact on the health of your business, pushing it towards growth.

- Global exposure: With business getting easier with smooth movement of goods across state borders, the Indian market is expected to consolidate from a fragmented one with the implementation of GST. This development will lead to an increase in production due to lesser operational costs, which will in turn leave them with more resources to try out their luck in the international market. Moreover, the introduction of a single market throughout the country happening with the implementation of GST will facilitate better administration with widespread use of electronic checks and balances signifying progress.

- Growth in GDP: The predicted growth trajectory with the introduction of GST is expected to raise GDP over 20%. This is expected to benefit the manufacturing sector drastically and even generate a large number of employment opportunities, in turn resulting in overall industry-wide growth.